All about Paul B Insurance

Wiki Article

Paul B Insurance Can Be Fun For Everyone

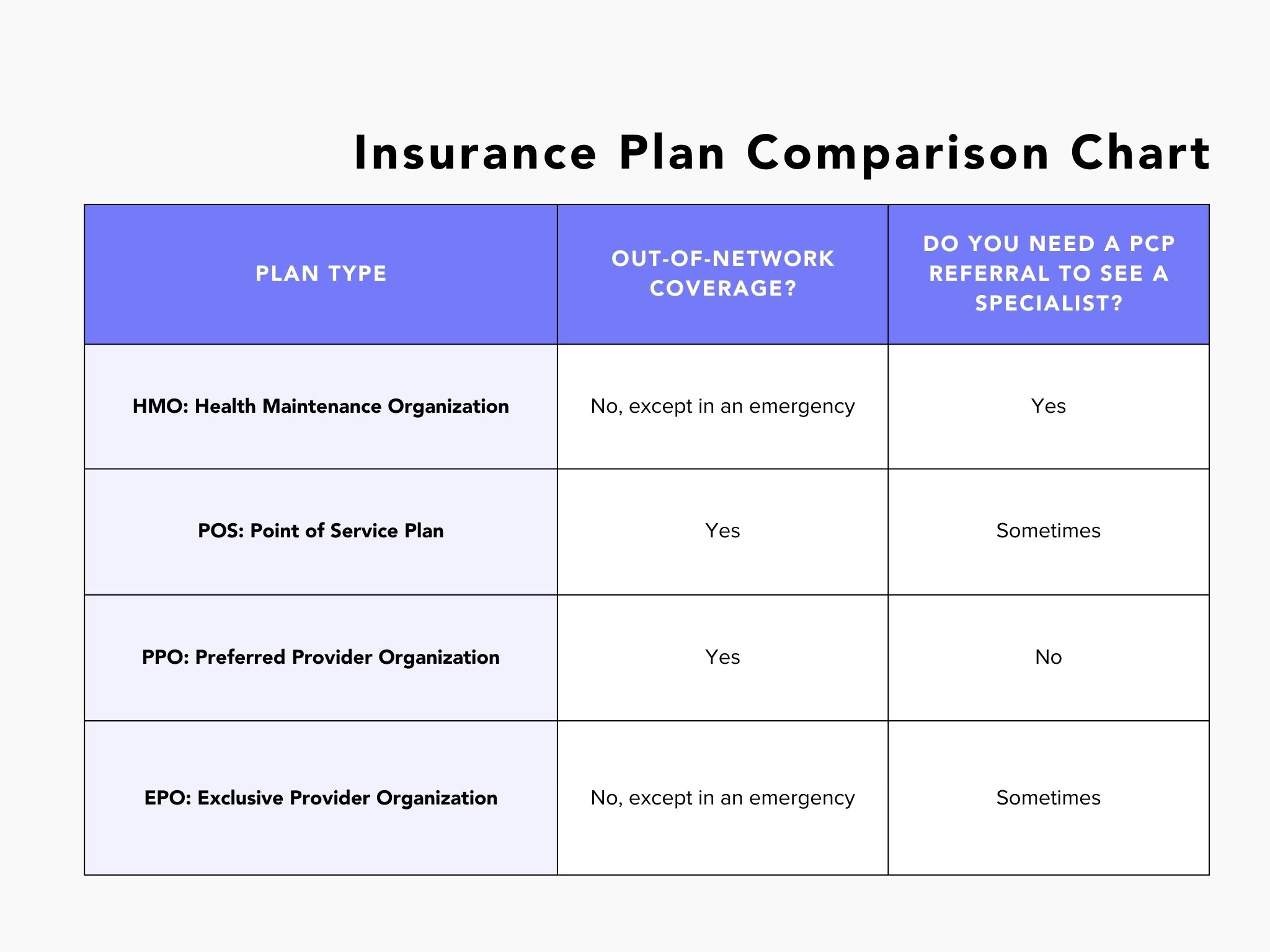

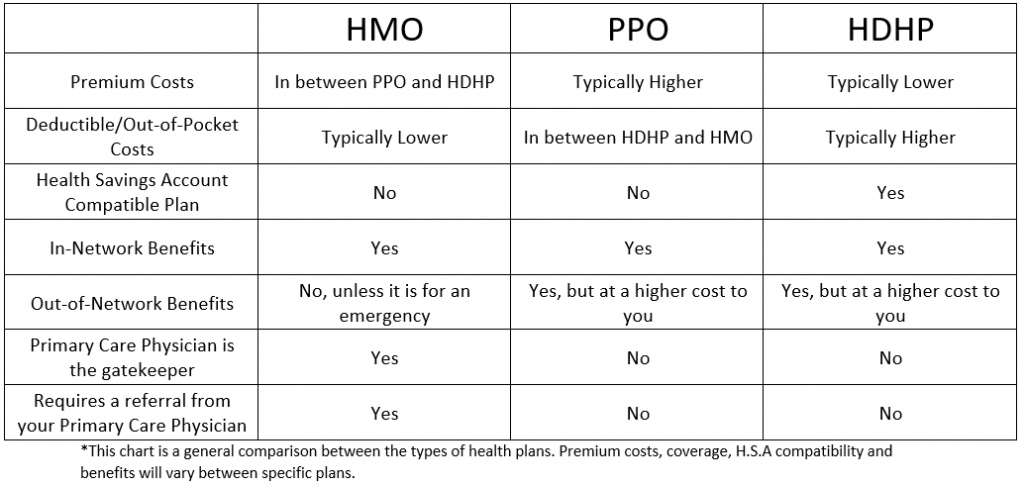

An HMO might require you to live or work in its service location to be eligible for protection. HMOs often provide incorporated care and concentrate on avoidance as well as health. A kind of strategy where you pay less if you make use of physicians, hospitals, and also various other healthcare providers that belong to the strategy's network.

A kind of health insurance plan where you pay less if you utilize carriers in the strategy's network. You can use doctors, healthcare facilities, and also carriers outside of the network without a reference for an added expense.

, as well as platinum. Bronze strategies have the least coverage, as well as platinum plans have the a lot of.

The 10-Minute Rule for Paul B Insurance

Any type of in your HMO's network. If you see a physician that is not in the network, you'll may have to pay the complete expense on your own. Emergency solutions at an out-of-network hospital should be covered at in-network prices, yet non-participating doctors that treat you in the hospital can bill you. This is the cost you pay every month for insurance.

A copay is a flat charge, such as $15, that you pay when you get care. Coinsurance is when you pay a percent of the charges for care, for instance 20%. These charges differ according to your plan and also they are counted towards your insurance deductible. There are no insurance claim develops to fill in.

Greater out-of-pocket costs if you see out-of-network physicians vs. in-network carriers, Even more documentation than with other plans if you see out-of-network providers Any in the PPO's network; you can see out-of-network physicians, but you'll pay more. This is the expense you pay each month for insurance. Some PPOs might have an insurance deductible.

Paul B Insurance Can Be Fun For Anyone

A copay is a flat fee, such as $15, that you pay when you get treatment. Coinsurance is when you pay a percent of the fees for care, for instance 20%. If your out-of-network medical professional bills even more than others in the location do, you might have to pay the balance after your insurance coverage pays its share.

Reduced costs than a PPO used by the same insurance company, Any type of in the EPO's network; there is no insurance coverage for out-of-network companies. This is the cost you pay monthly for insurance policy. Some EPOs may have an insurance deductible. A copay is a level fee, such as $15, that you pay when you obtain treatment.

This is the expense you pay each month for insurance coverage. Your plan might require you to pay the amount of a deductible prior to it covers treatment past preventative services.

The Single Strategy To Use For Paul B Insurance

We can not prevent the unanticipated from happening, however occasionally we can safeguard ourselves and our family members from the most awful of the financial fallout. Choosing the right type and amount of insurance is based on your details situation, such as kids, age, way of life, and also work benefits. Four kinds of insurance policy that a lot of economists advise include life, wellness, auto, and also long-lasting disability.

It consists of a death benefit and also a money value element. As the value grows, you can access the cash by taking a finance or taking out funds and also you can finish the policy by taking the money worth of the plan. Term life covers you for a collection amount of time like 10, 20, or three decades as well as your costs continue to be steady.

2% of the American population was without insurance policy protection in 2021, the Centers for Condition Control (CDC) reported in its National Facility for Wellness Stats. More than 60% obtained their coverage with a company or in the personal insurance market while the rest were covered by government-subsidized programs including Medicare and also Medicaid, veterans' advantages programs, and also the federal industry established under the Affordable Treatment Act.

Some Ideas on Paul B Insurance You Need To Know

According to the Social Security Management, one in 4 employees going into the labor force will come to be handicapped before they get to the age of retirement. While wellness insurance coverage pays for hospitalization and also medical bills, you are often burdened with all of the costs that your paycheck had actually covered.

This would website link certainly be more the finest option for protecting affordable handicap coverage. If your company doesn't use long-lasting protection, right here are some things to take into consideration before buying insurance policy on your very own: A policy that assures revenue substitute is optimal. Lots of policies pay 40% to 70% of your income. The cost of special needs insurance coverage is based upon several variables, consisting of age, way of living, as well as wellness.

Nearly all states call for chauffeurs to have automobile insurance coverage as well as the few that don't still hold drivers monetarily responsible for any damage or injuries they create. Here are your alternatives when buying car insurance policy: Obligation coverage: Pays for home damage and injuries you trigger to others if you're at mistake for a mishap as well as additionally covers litigation prices as well as judgments or negotiations if you're filed a claim against as a result of an auto crash.

Some Known Questions About Paul B Insurance.

Employer protection is typically the most effective option, yet if that is unavailable, get quotes from numerous providers as numerous give discounts if you buy greater than one sort of insurance coverage.

discover hereWhen comparing plans, there are a few aspects you'll want to take into account: network, price and also benefits. Check out each plan's network and also identify if your preferred carriers are in-network. If your physician is not in-network with a strategy you are thinking about but you wish to proceed to see them, you may desire to consider a various plan.

Attempt to discover the one that has the most advantages and also any kind of specific medical professionals you require. You can alter health and wellness plans if your company provides even more than one plan.

Paul B Insurance - Truths

You will certainly have to pay the premiums on your own. ; it may set you back less than private wellness insurance, which is insurance that you get on your very own, as well as the advantages may be much better. If you get approved for Federal COBRA or Cal-COBRA, you can not be refuted protection as a result of a medical condition.

You may require this letter when you obtain a new team health strategy or apply for an individual health plan. Private health and wellness strategies are strategies you buy on your very own, for yourself or for your household.

Some HMOs offer a POS plan. Fee-for-Service plans are often thought of as traditional strategies.

Report this wiki page